San Bernardino County homeowners overpay $650/year due to assessment errors. We fix that.

✔ 100% Done-for-You - We handle everything

✔ Licensed Tax Pros - California experts

✔ Only Pay If We Win - 25% contingency

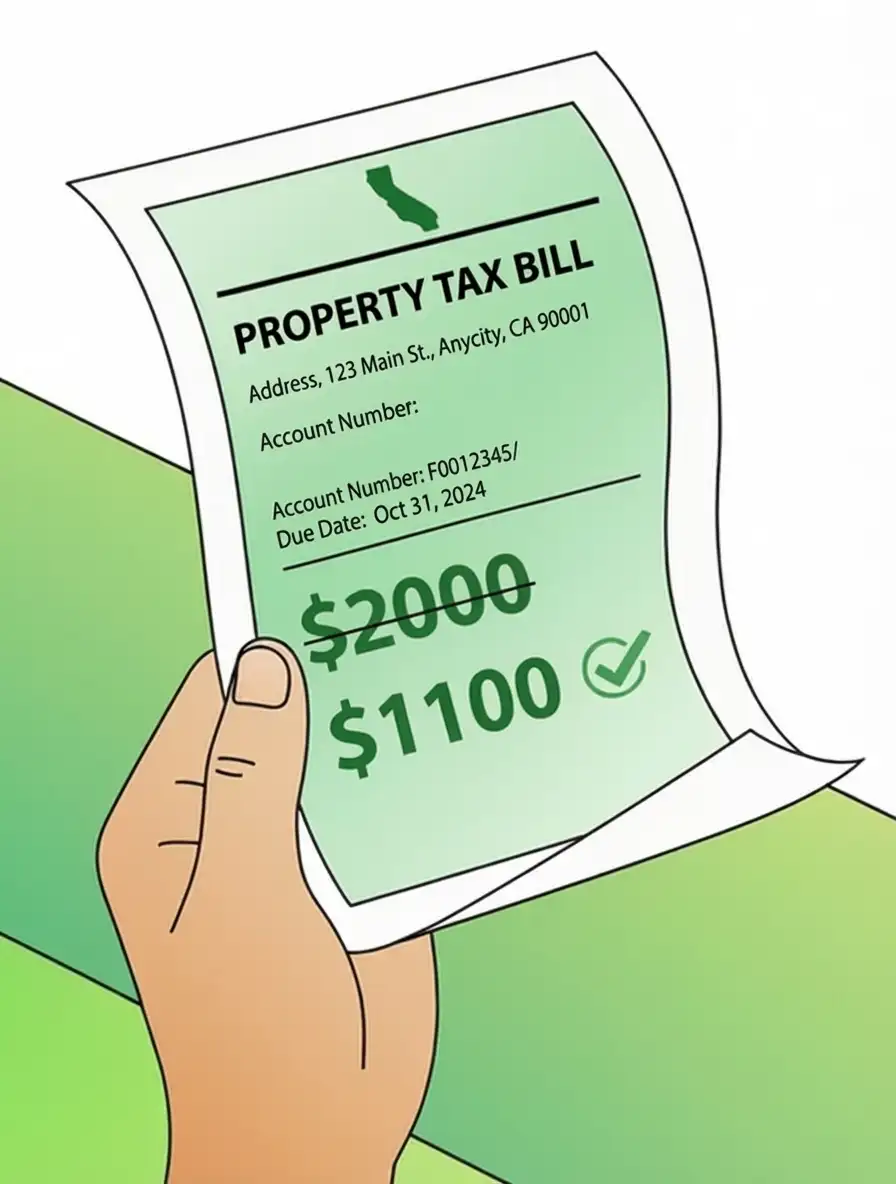

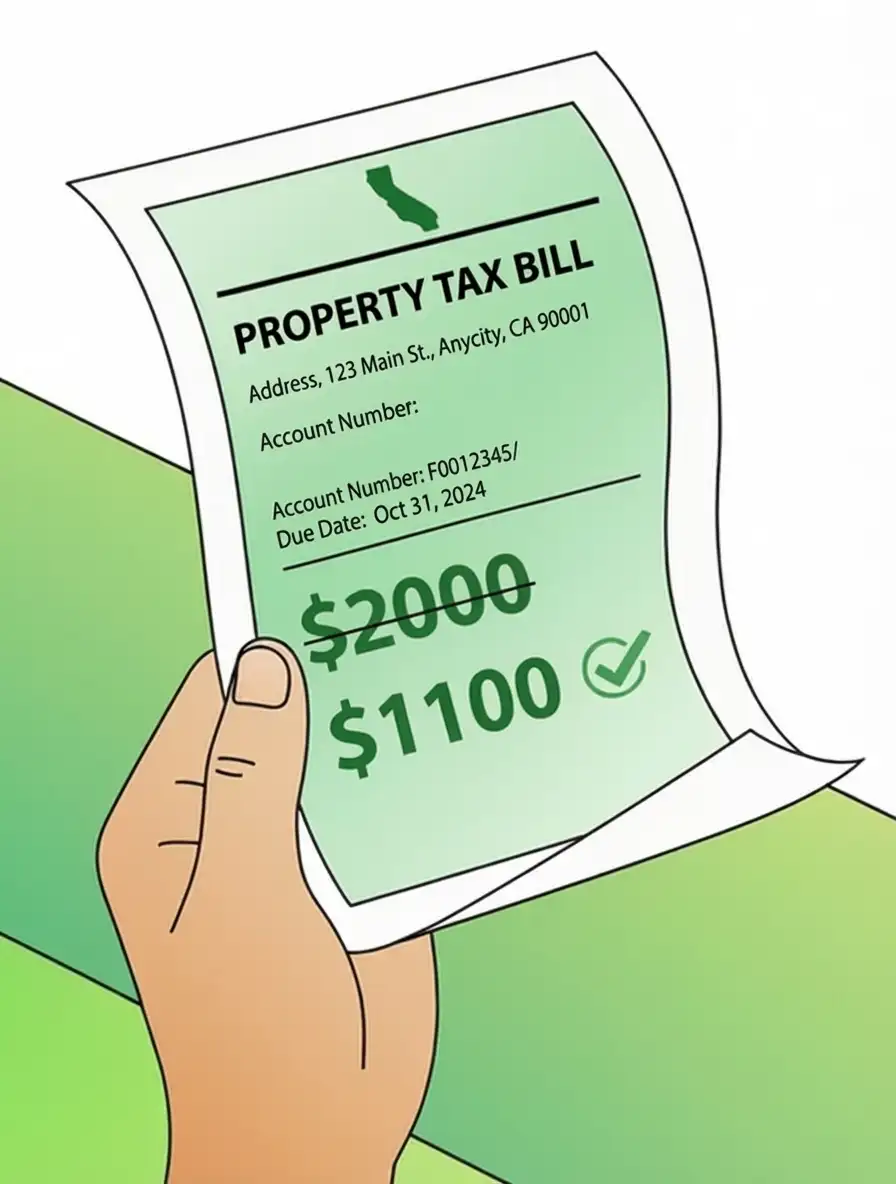

If you just opened your San Bernardino County property tax bill and felt that familiar punch to the gut, you're not alone. Homeowners from Rancho Cucamonga to Fontana are discovering their assessments jumped 8-15% this year, while their home values stayed flat or even dropped. The worst part? Many of these increases are based on outdated or incorrect data that you're legally allowed to challenge.

San Bernardino County covers 20,105 square miles with wildly different property values - a $600K home in Rancho Cucamonga sits in the same county as a $200K home in Barstow. This massive territory makes accurate assessments nearly impossible using automated systems. The Assessor's office relies heavily on computer models that miss crucial details: your home's actual condition, neighborhood changes, or recent comparable sales that should lower your value. When these models get it wrong, you overpay - sometimes for years.

Here's what most San Bernardino County homeowners don't realize: assessment errors compound every year until you challenge them. If your $450K home is incorrectly assessed at $500K, you're overpaying roughly $600 annually at current tax rates. Over five years, that's $3,000 you'll never get back. The Appeals Board corrected over 60% of appeals filed last year, but less than 2% of homeowners actually file. The system counts on your silence.

You might think "I'll just file the appeal myself and save the fee." We understand that instinct, but here's the reality: San Bernardino County's Assessment Appeals Board sees hundreds of cases monthly. They can spot amateur presentations immediately. Without proper comparable sales analysis, market trend data, and knowledge of assessment methodology, most DIY appeals get denied in under 10 minutes. You get one shot per year - why risk it?

Successful appeals require three things the Appeals Board respects: licensed professional representation, comprehensive market analysis using recent sales data, and presentation that follows their specific procedures. We've appeared before San Bernardino County's Appeals Board over 200 times and know exactly what evidence they find compelling. More importantly, we know which arguments they immediately dismiss, saving everyone time and maximizing your chances of success.

Our fee is 25% of your first year's tax savings - but only if we win. If your assessment drops by $50K (typical for our successful cases), you save about $600 annually. We keep $150, you keep $450 every year going forward. Over 10 years, you're ahead by $4,350 from that single appeal. If we don't reduce your assessment, you pay nothing. This isn't a gamble - it's a smart financial decision with zero downside.

San Bernardino County property tax appeals must be filed within 60 days of your assessment notice, with an absolute deadline of September 15th. Miss this window and you're stuck overpaying for another full year. The good news? Starting your appeal takes just 5 minutes of your time. We handle everything else: gathering comparable sales, preparing evidence, scheduling hearings, and presenting your case. You literally do nothing except potentially save thousands.

Ready to stop overpaying San Bernardino County property taxes? Get your free assessment analysis now and see exactly how much you could save. Remember - you only pay our fee if we successfully cut your tax bill.

Signup to have TaxDrop take care of your assessment protest for you. It takes less than 3 minutes to enroll and there is no fee if we don't win.

Step 1: Review Your Assessment Receive Assessed Value Notice by July 1 showing property valuation.

Step 2: File Your Appeal Submit Assessment Appeal Application with supporting evidence between July 2 – September 15.

Step 3: Application Review Clerk reviews application and schedules hearing (60-90 days after filing).

Step 4: Hearing Preparation Gather comparable sales data, appraisals, and documentation.

Step 5: Appeals Board Hearing Present case to Board panel (typically 4-9 months after filing).

Step 6: Decision & Adjustment Board issues written decision; if successful, assessed value reduced and tax refund issued (30-60 days after hearing).

Filing Deadlines:

The deadline to file a property tax appeal in San Bernardino County is September 15, with the filing period opening July 2. This gives homeowners approximately 75 days to challenge their property's assessed value if it appears too high. Missing this deadline means waiting until the next tax year to file your appeal, potentially costing you thousands in overpaid taxes.

Property tax appeals in San Bernardino County typically save homeowners $800-$3,500 annually, with some achieving reductions of $5,000 or more. The exact savings depend on your home's assessed value and the reduction achieved through the appeal process. Even a modest 10% assessment reduction on a $400,000 home saves approximately $400 yearly in San Bernardino County.

You can check your property's assessed value online through the San Bernardino County Assessor's website by entering your address. The portal displays your assessed value, property characteristics, recent sales comparisons, and tax history. This information helps determine if your assessment appears inflated compared to similar properties in San Bernardino, Victorville, or Ontario.

A successful property tax appeal in San Bernardino County reduces your home's assessed value, directly lowering your annual property tax bill. The savings continue each year until your next reassessment, potentially saving thousands over time. Professional services like TaxDrop handle the entire process with no upfront costs, charging only when they achieve savings.

Property taxes in San Bernardino County are calculated by multiplying your home's assessed value by the local tax rate, typically ranging from 1.0% to 1.3%. The rate includes charges from the county, cities like San Bernardino and Victorville, school districts, and special assessment districts. A $500,000 home typically pays $5,000-$6,500 annually in property taxes.

Professional property tax appeal services achieve successful reductions in approximately 70-80% of cases compared to 30-40% for self-filed appeals in San Bernardino County. Licensed professionals understand local assessment practices, comparable sales analysis, and appeal procedures that maximize reduction potential. Many services operate on contingency, charging only when they secure savings.

The Homeowners' Exemption reduces your assessed value by up to $7,000 in San Bernardino County, saving approximately $70-$91 annually. Additional exemptions include disabled veterans' exemptions and senior citizens' exemptions for qualifying homeowners. These exemptions must be filed separately from appeals and can be combined with successful assessment reductions.

Properties in San Bernardino County are often overassessed due to outdated sales data, failure to account for property defects, or rapid market changes affecting cities like Ontario and Victorville. The assessor's office processes thousands of properties annually, sometimes missing specific conditions that reduce market value. Regular market fluctuations can also create temporary overassessments requiring correction through appeals.

Yes, landlords and investors can appeal property taxes on rental and commercial properties throughout San Bernardino County. Investment property appeals often achieve larger dollar savings due to higher assessed values, significantly improving cash flow and return on investment. Professional services handle all property types across San Bernardino, from single-family rentals to commercial buildings.

Missing the September 15 deadline means waiting until the next tax year to file your San Bernardino County property tax appeal. However, you can still research comparable sales, document property issues, and prepare your case for the following year's filing period. Starting early preparation with professional help ensures you're ready when the next appeal window opens.

The property tax appeal process in San Bernardino County typically takes 3-6 months from filing to final decision. Initial reviews occur within 30-60 days, with hearings scheduled if needed for complex cases. Professional services handle all communications and deadlines, keeping you informed throughout the process while managing the technical requirements.

Start your San Bernardino County property tax appeal by checking your potential savings at app.taxdrop.com where you can enter your address instantly. Licensed experts handle evidence preparation, filing deadlines, and representation throughout the appeal process. The service operates with no upfront costs, charging only when they successfully reduce your assessment and save you money.