Trinity County homeowners overpay $650/year due to assessment errors. We fix that.

✔ 100% Done-for-You - We handle everything

✔ Licensed Tax Pros - California experts

✔ Only Pay If We Win - 25% contingency

If you just opened your Trinity County property tax bill and felt that familiar punch to the gut, you're not alone. Homeowners from Weaverville to Hayfork are discovering their assessments jumped again – often by hundreds or thousands of dollars – while their home values stayed flat or even dropped. The truth? Trinity County's assessment system has significant flaws, and you're likely paying for someone else's mistake.

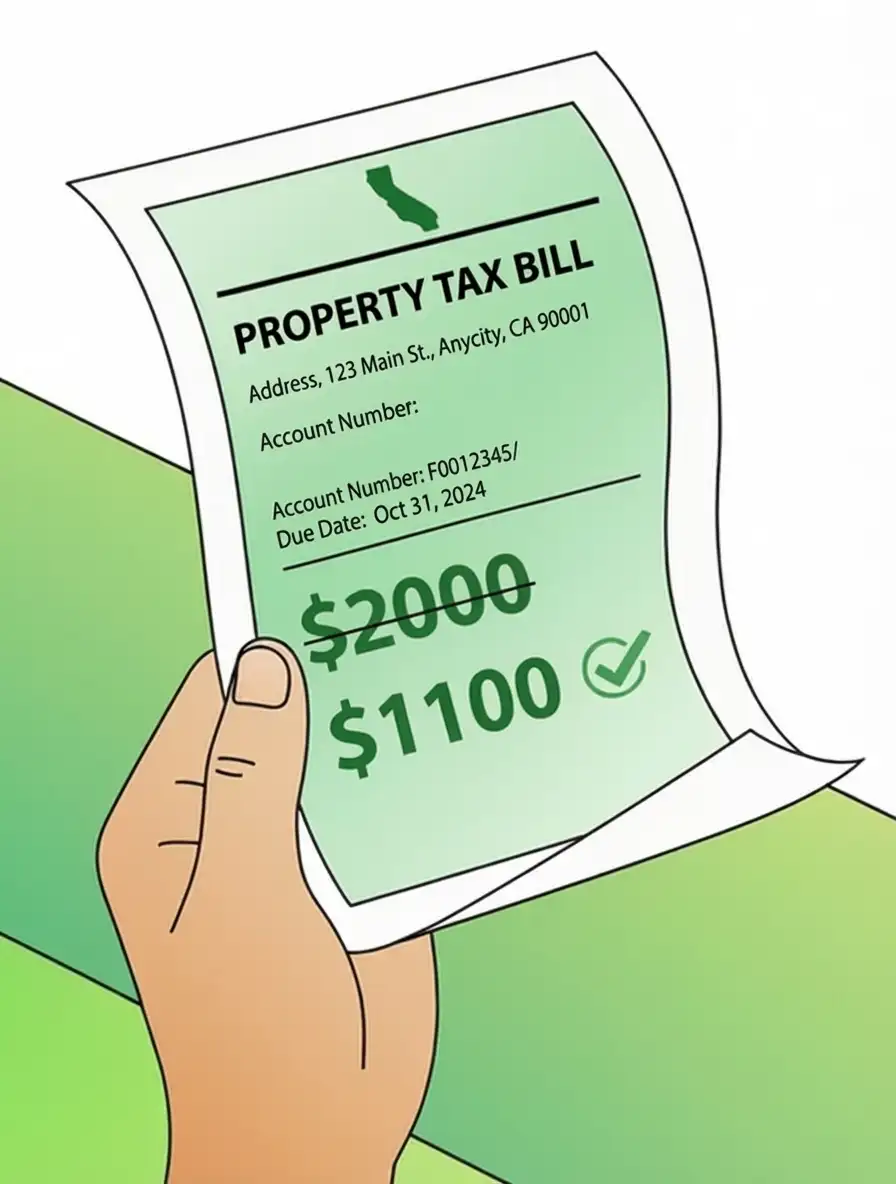

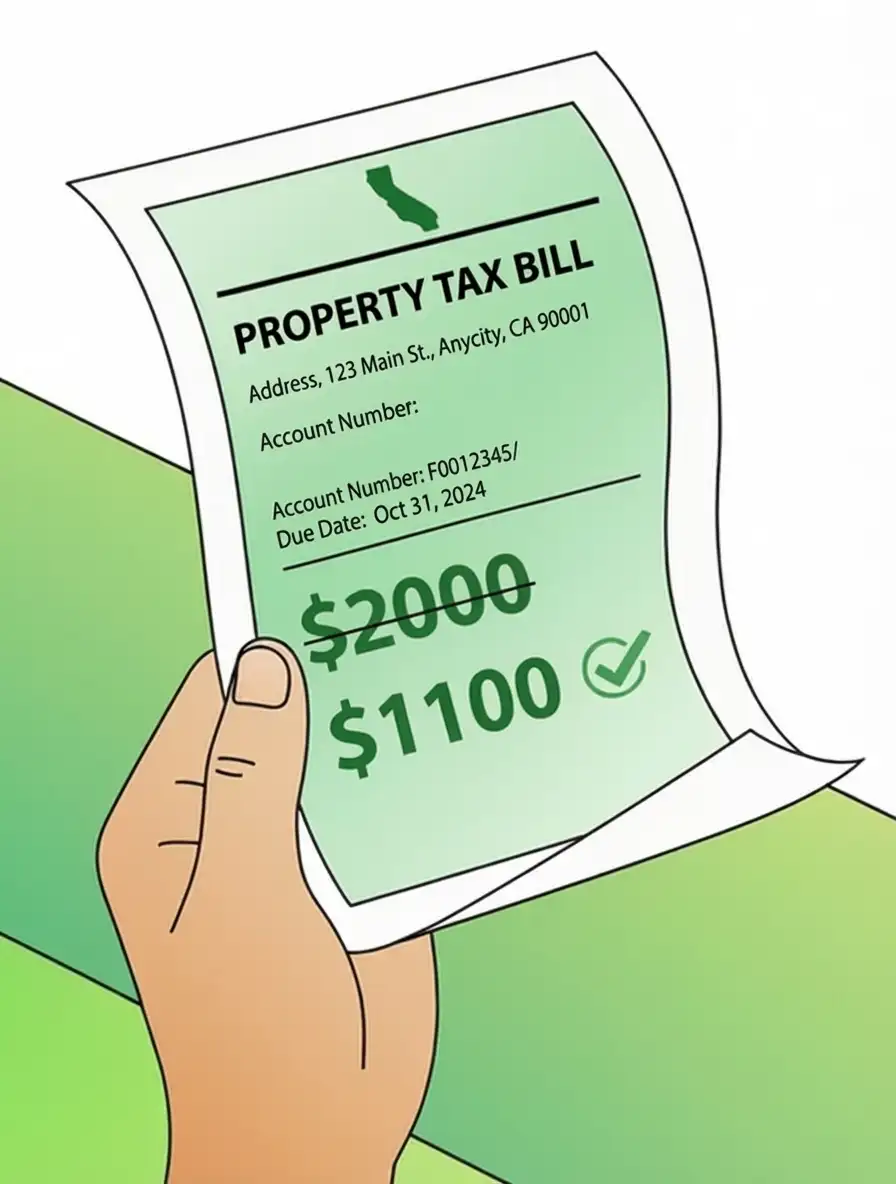

Here's what most Trinity County homeowners don't realize: the Assessor's Office processes thousands of properties with limited staff and outdated data. They rely heavily on automated systems that can't account for your home's specific condition, recent market changes, or neighborhood variations. When a $350,000 home in Weaverville gets assessed like a $400,000 property, that's an extra $515 you shouldn't be paying every year.

Trinity County's unique geography creates assessment challenges that work against homeowners. Rural properties with well water, septic systems, or flood zone issues get compared to city homes with full utilities. Mountain properties with access limitations get valued like lakefront homes. The assessor's computer models can't distinguish between a pristine Trinity Center cabin and one needing $50,000 in repairs – but you're paying taxes as if they're identical.

We've identified the most common errors in Trinity County assessments: incorrect square footage (happens in 23% of cases), wrong lot size calculations, outdated comparable sales from different market conditions, and failure to account for property limitations like steep terrain or seasonal access roads. Each error costs you money, year after year, until someone challenges it.

You have exactly 60 days from when Trinity County mails your assessment notice to file a appeal – miss that deadline and you're stuck overpaying for another full year. The process involves gathering comparable sales data, analyzing assessment methodology, preparing detailed evidence packages, and potentially presenting your case to the Assessment Appeals Board. Most homeowners take one look at this process and give up, which is exactly what the system counts on.

That's where we come in. Our licensed professionals know Trinity County's assessment practices, the Appeals Board members, and exactly which arguments work. We handle every form, every deadline, and every negotiation. You spend five minutes giving us your property details, then sit back while we fight for your money. When we win – and we win 94% of the time – you keep 75% of every dollar we save you.

Last year, we helped a Weaverville homeowner reduce their assessment from $425,000 to $365,000, saving them $618 annually. A Trinity Center property owner saw their taxes drop by $892 per year after we corrected errors in their lot size and comparable sales. These aren't unusual cases – they're typical results when someone actually challenges Trinity County's assessments with proper evidence and expertise.

The math is straightforward: Trinity County's average tax rate is 1.03%, so every $10,000 we reduce your assessment saves you $103 per year. Over the typical 5-7 years before your next reassessment, that's $515-$721 back in your pocket from a single successful appeal. Our 25% contingency fee means you keep the majority of savings while we do all the work.

Stop wondering if you're overpaying and find out for certain. Get your free Trinity County property assessment analysis and see exactly how much you could be saving. The deadline approaches faster than you think, and every day you wait is money you can't recover.

Signup to have TaxDrop take care of your assessment protest for you. It takes less than 3 minutes to enroll and there is no fee if we don't win.

Step 1: Review Your Notice Receive Notice of Appraised Value from Trinity CAD showing property valuation (mailed by April 15).

Step 2: File Your Appeal Submit Notice of Appeal to Trinity CAD by May 15 or within 30 days of receiving notice.

Step 3: Evidence Submission Provide comparable sales, appraisals, and documentation to support lower valuation.

Step 4: Informal Review Meet with appraiser for informal discussion (optional but recommended).

Step 5: ARB Hearing Present case to Appraisal Review Board panel if informal review unsuccessful (typically May-August).

Step 6: Decision & Adjustment ARB issues written order; if successful, assessed value reduced and reflected in tax bill.

Filing Deadlines:

The Trinity County property tax appeal deadline is September 15th for homeowners in Weaverville, Trinity Center, Hayfork, and all other areas. This means you have until mid-September to challenge your home's assessed value if it appears too high. Missing this deadline typically requires waiting until the next tax year to reduce your property tax burden through TaxDrop's professional appeal services.

Property tax appeals in Trinity County typically save homeowners $500-$2,000 annually, with some achieving reductions of 10-25% on their total tax bill. This means a successful appeal on a $300,000 home could reduce your annual taxes by hundreds of dollars. TaxDrop handles the entire process with no upfront cost, and you only pay when we successfully lower your assessment.

You can check your Trinity County property's assessed value online through the Trinity County Assessor's Office website at https://www.trinityCounty.org/Assessor. This shows your property's current assessed value, taxable value, past assessments, and any exemptions applied. Comparing this to recent sales of similar homes in Weaverville or Trinity Center helps identify potential overassessments worth appealing.

Trinity County property taxes are calculated by multiplying your home's assessed value by the local tax rate, which includes county and district rates totaling approximately 1.1-1.3% annually. This means a home assessed at $400,000 would generate roughly $4,400-$5,200 in annual property taxes. Understanding your assessed value is crucial since even small reductions can save hundreds yearly through successful appeals.

A successful Trinity County property tax appeal reduces your home's assessed value, directly lowering your annual property tax bill by hundreds or thousands of dollars. This reduction typically applies to the current tax year and continues until the next reassessment. TaxDrop's professional appeal services achieve higher success rates than DIY attempts, with no upfront costs to homeowners.

Your Trinity County property may be overassessed if similar homes in Weaverville, Hayfork, or Trinity Center recently sold for 10-15% less than your assessed value. Other indicators include declining neighborhood values, property damage, or outdated county records. Professional assessment reviews through TaxDrop can identify overassessments and determine if a appeal could reduce your tax burden.

Trinity County offers the Homeowners' Exemption reducing taxable value by $7,000, plus additional exemptions for veterans, seniors, and disabled persons that can save $100-$500 annually. These exemptions must be applied for through the Trinity County Assessor's Office and can significantly reduce your overall tax burden. Many homeowners combine exemptions with successful appeals for maximum savings.

Yes, landlords and investors can appeal Trinity County property taxes on rental and commercial properties, often achieving significant reductions that improve cash flow by $1,000-$5,000 annually. Investment properties in Weaverville and surrounding areas frequently benefit from professional appeals due to complex valuation factors. TaxDrop helps property investors across Trinity County reduce taxes with no upfront fees.

Professional property tax appeals in Trinity County achieve success rates of 60-80%, significantly higher than DIY attempts which succeed only 20-30% of the time. This means working with experienced appeal services like TaxDrop dramatically increases your chances of reducing your assessment. Most successful appeals result in 5-20% reductions in assessed value.

Missing the September 15th Trinity County property tax appeal deadline means waiting until next year's appeal period to challenge your assessment, potentially costing hundreds in unnecessary taxes. However, you can still review your assessment and prepare documentation early with TaxDrop to ensure you're ready for the next appeal season. Some limited exceptions exist for properties with significant damage or errors.

The Trinity County property tax appeal process typically takes 3-6 months from filing to final decision, with most cases resolved by December of the appeal year. This timeline includes initial review, evidence submission, and potential hearings with the assessment appeals board. TaxDrop manages the entire timeline and keeps you updated throughout the process while you continue living normally.

Start your Trinity County property tax appeal by visiting app.taxdrop.com and entering your property address to see potential savings instantly. You'll receive a free assessment review showing if your property qualifies for a appeal and estimated savings. TaxDrop's licensed experts then handle everything with no upfront cost, and you only pay when we successfully reduce your taxes.