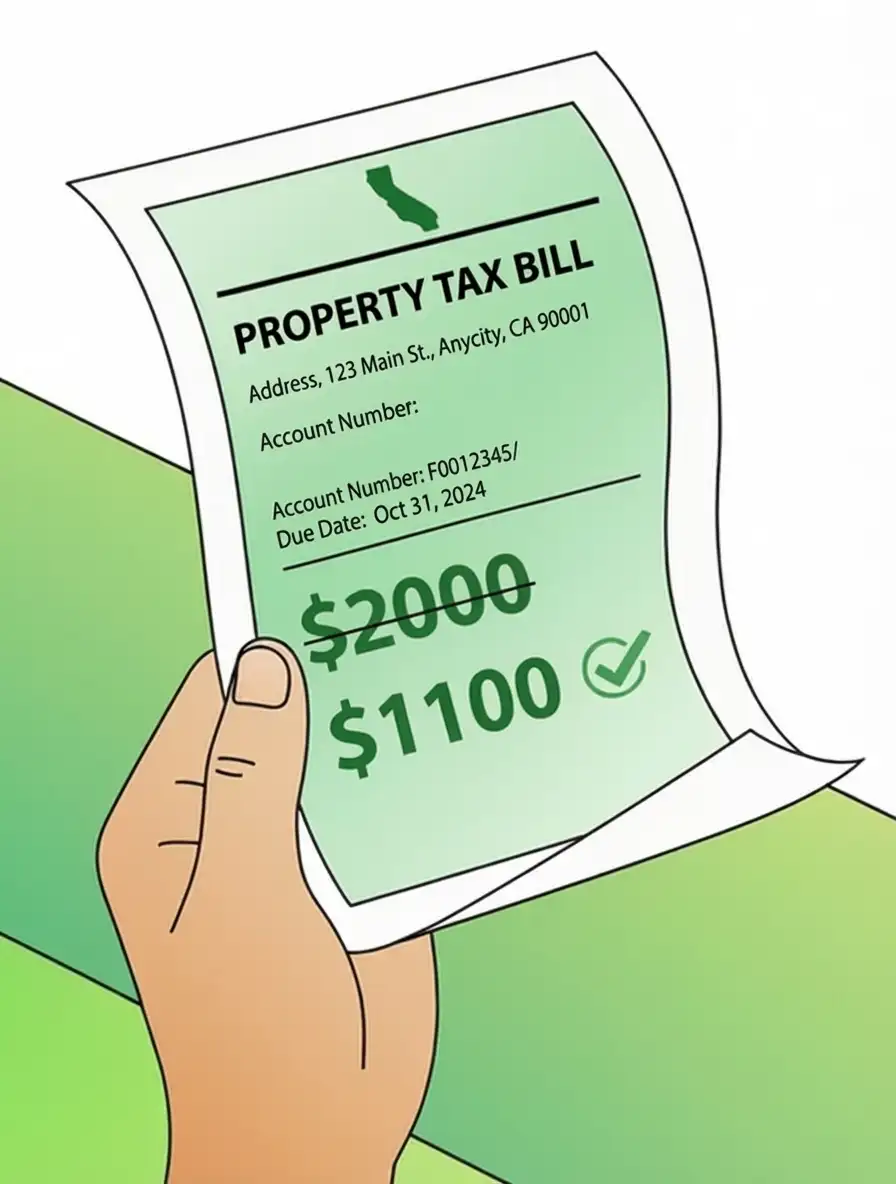

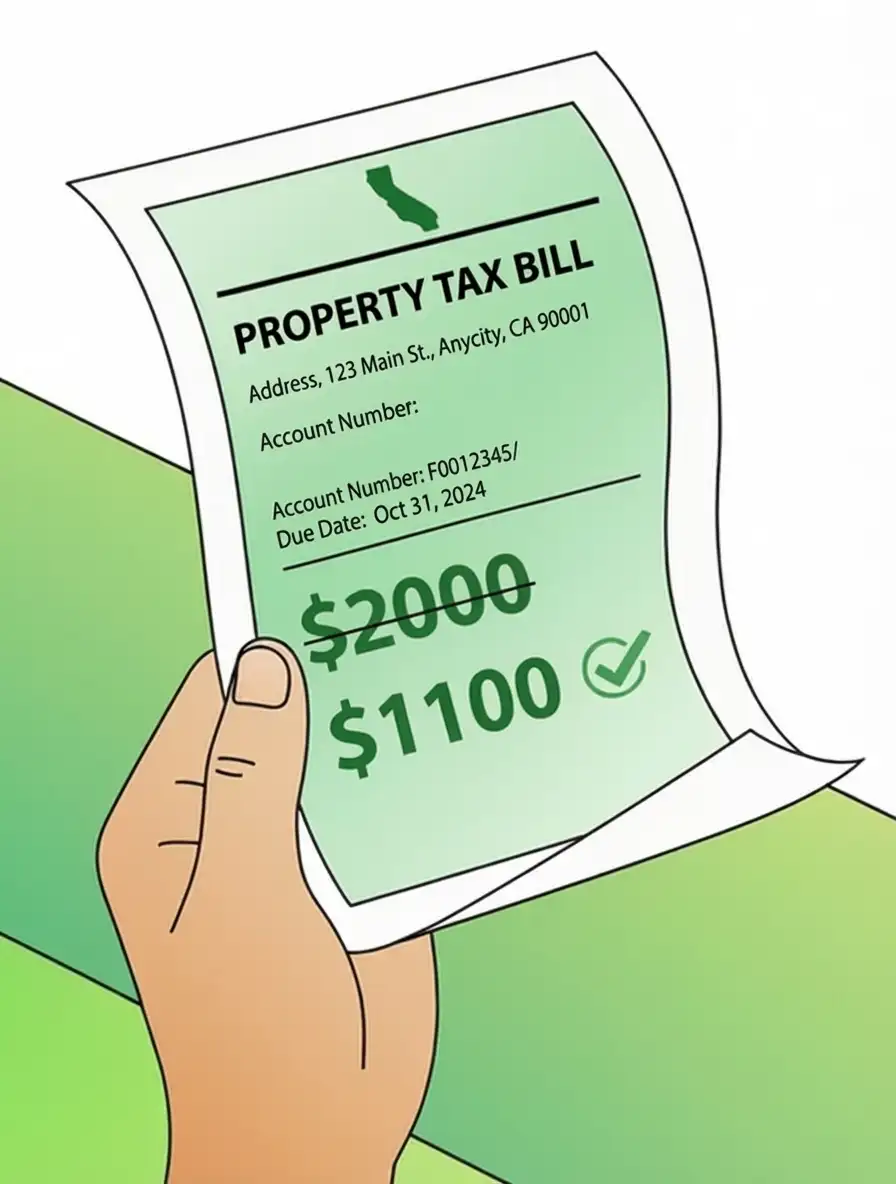

Tuolumne County homeowners overpay $650/year due to assessment errors. We fix that.

✔ 100% Done-for-You - We handle everything

✔ Licensed Tax Pros - California experts

✔ Only Pay If We Win - 25% contingency

If you just opened your Tuolumne County property tax bill and felt that familiar punch to the gut, you're not alone. Homeowners across Sonora, Jamestown, and Groveland are watching their tax bills climb while their home values stagnate or drop. The worst part? Many of these assessments contain errors that cost you hundreds or thousands annually - money that should stay in your pocket, not fund county coffers.

Here's what most homeowners don't realize: Tuolumne County's Assessor's Office processes over 60,000 properties with a small staff. They rely heavily on automated valuation models and mass appraisal techniques that often miss property-specific issues. Your home might be assessed as if it has a perfect foundation when yours needs $15,000 in repairs. Or you're being taxed on square footage that includes an unpermitted addition you can't legally use. These aren't rare exceptions - they're systematic problems that create real savings opportunities for homeowners who know how to spot them.

The assessment process becomes even more problematic during market shifts. When home sales slow down in areas like Chinese Camp or Twain Harte, assessors often rely on outdated comparable sales or use properties from different micro-markets. Your mountain cabin might be assessed using sales data from lakefront properties, or your Sonora home compared to newer developments in Phoenix Lake. Each of these mismatches inflates your assessed value and your annual tax bill.

Let's talk numbers that matter to your budget. In Tuolumne County, the average effective tax rate hovers around 1.08%. If your $400,000 home is overassessed by just $30,000, you're overpaying $324 every year. That's a car payment. Over ten years, that single error costs you $3,240 - enough for a family vacation or emergency fund. And here's the kicker: assessment errors compound. Once your property is overvalued, that inflated baseline affects future assessments, multiplying your losses year after year.

The deadline pressure makes this worse. Tuolumne County requires property tax appeals within 60 days of your assessment notice, typically by September 15th. Miss that window, and you're locked into overpaying for another full year. No exceptions, no extensions, no mercy. That's why so many homeowners end up trapped in a cycle of overpayment - they know something's wrong but don't have the time or expertise to act before the deadline slams shut.

You might think, "I'll just handle this myself." Here's why that rarely works: successful appeals require intimate knowledge of California assessment law, comparable sales analysis, and the specific procedures of Tuolumne County's Assessment Appeals Board. You need to understand concepts like Proposition 13 base year values, factored base year values, and decline-in-value assessments. You'll spend dozens of hours researching comparable properties, preparing evidence packets, and potentially attending hearings during business hours.

Even if you have the time, the Assessment Appeals Board sees hundreds of cases annually. They can spot amateur presentations immediately and often dismiss cases with minor procedural errors. Professional representation isn't just helpful - it's practically essential for meaningful results. That's exactly why we exist: to level the playing field between individual homeowners and the county's assessment machinery.

Our approach starts with data the county assessor doesn't always consider. We analyze recent sales of truly comparable properties in your specific area - not just similar square footage, but similar age, condition, location factors, and market timing. For Tuolumne County properties, this means understanding the difference between Sonora's established neighborhoods and newer developments, between lakefront and hillside properties, between homes with city utilities and those on wells and septic systems.

We also identify assessment errors the automated systems miss. Foundation issues, outdated electrical systems, septic problems, easements that limit property use, or zoning restrictions that affect value. Our licensed professionals know exactly how to document these factors and present them in the format the Assessment Appeals Board expects. We speak their language and follow their procedures, dramatically increasing your chances of success.

Here's the math that matters: our 25% contingency fee only applies to your actual tax savings. If we reduce your assessed value by $40,000, saving you $432 annually, our fee is $108 for that first year. You keep $324 in immediate savings, plus the same $432 every year going forward. Over five years, that single successful appeal saves you $2,160 while costing you just $108. The return on investment is immediate and continues for years.

Even better, you risk absolutely nothing. If we don't reduce your assessment, you pay nothing. If we achieve only a small reduction, you pay only a small fee. Your savings always exceed your cost, guaranteed. This isn't a gamble - it's a smart financial decision that pays for itself from day one.

Signup to have TaxDrop take care of your assessment protest for you. It takes less than 3 minutes to enroll and there is no fee if we don't win.

Step 1: Review Your Assessment Receive Assessed Value Notice by July 1 showing property valuation.

Step 2: File Your Appeal Submit Assessment Appeal Application with supporting evidence between July 2 – September 15.

Step 3: Application Review Clerk reviews application and schedules hearing (60-90 days after filing).

Step 4: Hearing Preparation Gather comparable sales data, appraisals, and documentation.

Step 5: Appeals Board Hearing Present case to Board panel (typically 4-9 months after filing).

Step 6: Decision & Adjustment Board issues written decision; if successful, assessed value reduced and tax refund issued (30-60 days after hearing).

Filing Deadlines:

The deadline to file a property tax appeal in Tuolumne County is September 15th or 60 days from your assessment notice date, whichever is later. Missing this deadline means waiting until next year to challenge your assessment and potentially overpaying hundreds or thousands in property taxes. Homeowners in Sonora, Jamestown, and throughout Tuolumne County should mark this date to ensure they don't miss their opportunity for tax savings.

Property tax appeals in Tuolumne County typically save homeowners $500-$3,000 annually, with some saving even more depending on their home's overassessment. A successful appeal reduces your assessed value, which directly lowers your tax bill for years to come. Many California homeowners see 5-15% reductions in their assessed value through professional appeal services.

You can check your property's assessed value online through the Tuolumne County Assessor's Office website by searching your address or parcel number. This shows your current assessed value, taxable value, and any exemptions applied to your Sonora or other Tuolumne County property. Comparing this to recent sales of similar homes helps determine if you're overassessed and should file a appeal.

A successful property tax appeal in Tuolumne County permanently reduces your home's assessed value, resulting in lower property tax bills every year going forward. Even a modest 10% reduction can save homeowners $800-$1,500 annually in cities like Sonora and Jamestown. The savings compound over time, potentially saving thousands over the life of your ownership.

Property taxes in Tuolumne County are calculated by multiplying your home's assessed value by the local tax rate, which averages around 1.1-1.3% countywide. Your assessed value is typically your purchase price plus annual inflation adjustments (up to 2% per year under California's Proposition 13). Cities like Sonora may have additional assessments that increase your total tax rate.

The Homeowners' Exemption in Tuolumne County reduces your assessed value by $7,000, saving most homeowners $70-$90 annually on their property taxes. Additional exemptions are available for disabled veterans, seniors over 65, and other qualifying circumstances. These exemptions must be applied for separately and can provide meaningful tax savings when combined with a successful appeal.

Homes in Tuolumne County are often overassessed when the assessor uses outdated comparable sales, doesn't account for property condition issues, or applies incorrect square footage or lot size data. Rapid price changes in areas like Sonora and Tuolumne City can also lead to inflated assessments. If your home's assessed value seems high compared to recent neighborhood sales, a appeal may be warranted.

Yes, landlords and investors can appeal property taxes on rental and commercial properties throughout Tuolumne County, including Sonora, Jamestown, and Tuolumne City. Successful appeals on investment properties can significantly improve cash flow and investment returns over time. The same deadlines and processes apply to all property types, making professional assistance valuable for busy investors.

Approximately 60-70% of professionally prepared property tax appeals in Tuolumne County result in some reduction, with average savings of 8-12% of assessed value. DIY appeals have lower success rates due to incomplete documentation and unfamiliarity with assessment procedures. Professional services typically achieve better outcomes by presenting compelling comparable sales data and identifying assessment errors.

Missing the September 15th deadline means you cannot appeal your current assessment and must wait until next year's appeal period to challenge your valuation. This could cost you hundreds or thousands in unnecessary property taxes for an entire year. However, you can still prepare early by reviewing your assessment and gathering documentation for next year's appeal opportunity.

The property tax appeal process in Tuolumne County typically takes 3-6 months from filing to final decision by the Assessment Appeals Board. Most cases are resolved through informal review before requiring a formal hearing. Professional services handle all paperwork, deadlines, and communications, making the process hassle-free for homeowners in Sonora and throughout the county.

Starting your property tax appeal is simple - enter your address at app.taxdrop.com to instantly see if you qualify for potential tax savings in Tuolumne County. Licensed professionals handle the entire process with no upfront costs, and you only pay if they successfully reduce your taxes. Many homeowners in Sonora and surrounding areas discover significant savings opportunities within minutes.